The Meaning of the Digits on Your Credit Card

February 7, 2011 at 2:00 am Chad Upton 12 comments

By Chad Upton | Editor

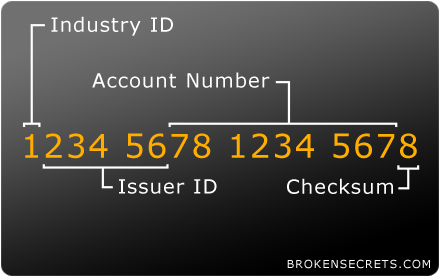

There are thousands of different credit cards from the major issuers, but all of them have one thing in common: the meaning of the numbers on the card.

Most major cards have 16 digits on them and each number has a specific meaning.

Digit 1 (Industry ID)

- 1 and 2 are Airline cards

- 3 – Travel and Entertainment

- ex. Amex

- 4, 5 – Banking and Financial

- ex. Visa, Mastercard

- 6 – Merchandising and Banking

- ex. Discover, Diners Club

- 7 – Petroleum

- 8 – Telecom

- 9 – Misc.

Digits 2-6 (Issuer ID)

Although all Visa cards start with the number 4, the following 5 digits indicate which bank that issued the Visa card. Mastercards start with 5, Discover starts with 6. You’ll notice that some websites don’t ask you what type of card you have — they obviously know what the digits on the card mean.

Digits 7-15 (Account ID)

The unique number that identifies your account.

Digit 16 (Checksum)

This single digit is one of the most important ones on the card. Much like the last digit of a barcode, the sole purpose of this digit is to allow validation of the rest of the number. In other words, there is a mathematical relationship between the numbers on the card, so if the number is entered incorrectly, the card validator system can indicate the card number was entered incorrectly.

You can validate a card number on your own too. Double every other number, starting with the first number. Add the result of those multiplications to all of the other digits on the card, treating all numbers as individual digits, including double digit results from the doubling operation. If the sum of all these numbers is divisible by ten, the number is valid according to the ISO standard. However, a valid card number doesn’t necessarily mean the number is an active account or that charges can be made with it.

In the early days of credit cards, they didn’t actually check this before imprinting a card for small purchases and larger purchases were verified with a phone call. Today, it’s usually done electronically. When your card is swiped, the number is validated by the point of sale system (using the method above) and if the card number is valid then an electronic request is sent to verify the charge will be accepted by the card issuer.

Some retail stores will ask to see your card so they can manually type in the last four digits on the card. This verifies that the number embossed in the card is the same number that is programmed to the magnet stripe on the back; this is one way retailers can catch counterfeit or reprogrammed cards before the goods leave the store.

Broken Secrets

Get updates from: Facebook | Twitter | Email | Kindle

Sources: Abby’s Guide, HowStuffWorks, Merriam Park, Mint

Entry filed under: Money. Tags: american express, amex, cc, credit card, mastercard, money, visa.

12 Comments Add your own

Leave a comment

Trackback this post | Subscribe to the comments via RSS Feed

1. Denisuca – nevastă de Coşmar » Diverse | February 7, 2011 at 7:16 am

Denisuca – nevastă de Coşmar » Diverse | February 7, 2011 at 7:16 am

[…] reprezintă cifrele de pe cardul […]

2. Kristen | February 7, 2011 at 1:23 pm

Kristen | February 7, 2011 at 1:23 pm

very interesting

3. Heather | February 8, 2011 at 10:08 am

Heather | February 8, 2011 at 10:08 am

I’ve always wondered at the numbers on a Credit Card. They seemed so random. Thanks for breaking the secret!

4. Elbyron | February 10, 2011 at 8:32 pm

Elbyron | February 10, 2011 at 8:32 pm

I knew about the first digit telling you who the card is from, but I didn’t realize there was a checksum digit at the end! So if someone gives me the first 15 digits of their card, I can figure out what the last one should be! Now if only I could also figure out their expiry date and cvs nuimber… lol

5. Unintentnional Housewife | March 15, 2011 at 11:20 pm

Unintentnional Housewife | March 15, 2011 at 11:20 pm

I love stuff like this! I guess I’m kind of a number geek, so it makes sense that I’m super excited about this post. With my years of retail experience, the whole 4 = VISA, 5 = MasterCard and 6 = Discover were pretty obvious to me. But I didn’t know the checksum fact – awesome. I also never knew why our credit card machine always asked us to type in the last four digits, but it makes total sense when I think about how one might go about making a counterfeit card. Not that I would think about such things…

6. jose antonio ruiz | April 7, 2012 at 5:09 am

jose antonio ruiz | April 7, 2012 at 5:09 am

is it possible to find out or trace the owner of a visa card with the last four digits of the card, who this person is?

7. CCfrauddetection | May 15, 2012 at 8:12 am

CCfrauddetection | May 15, 2012 at 8:12 am

is it possible to know if the origin country of a card with the digits?

8. creditcard | December 9, 2012 at 11:05 pm

creditcard | December 9, 2012 at 11:05 pm

#7, you can figure out the origin country by using the website bin lookup dot com.and typing in the first six digits.

9. cc1 | July 2, 2013 at 10:30 am

cc1 | July 2, 2013 at 10:30 am

If you have the last four digits (which includes the checksum), the formula for calculating the checksum, and an educated guess that the first number is normally a 4 or a 5, I wonder if you can guess or create your own credit card numbers?

10. Chad Upton | July 16, 2013 at 10:06 pm

Chad Upton | July 16, 2013 at 10:06 pm

You can see how to generate credit card numbers here: https://brokensecrets.com/2013/02/05/how-to-generate-credit-card-numbers/

11. Mike Jackson | March 30, 2015 at 2:59 pm

Mike Jackson | March 30, 2015 at 2:59 pm

Is there a way to figure out who issued a card if you only have the last four digits?

12. AKBAL | May 1, 2016 at 4:08 pm

AKBAL | May 1, 2016 at 4:08 pm

Hi my family member! I wish to say that this article is amazing, great written and include almost all significant infos. I’d like to peer more posts like this .